Since 1975, The San Diego Foundation and our donors have granted more than $1.1 billion to advance a vibrant quality of life in San Diego.

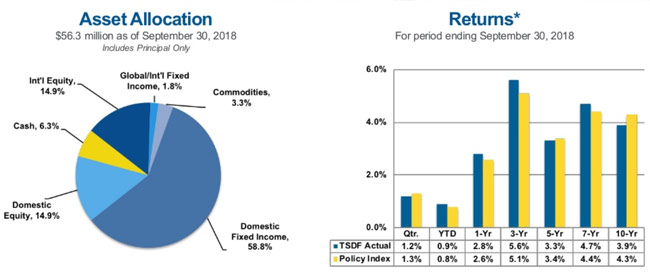

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q3 2018 call and review the slides shared by our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt] https://www.youtube.com/watch?v=wzYzPbOqY40[/embedyt]

Access the presentation slides >

Recent Trends

Steve Klosterman, Regional Director with Halbert Hargrove and The San Diego Foundation Board Investment Chair, kicked off the call and spoke about the trends that are driving the market, specifically as of September 30.

As we’ve seen, there has been a lot of concern about interest rates lately. And as Steve mentioned on the call, we are not overly concerned about interest rates and interest rate increases. The reason for this is that when yields are below 5%, rising rates have historically been associated with rising stock prices.

The real key with interest rates is what’s behind that rising of interest rates.

If it is because the economy is strong and the Federal Reserve Board is concerned about overheating, then that bodes well. If the Federal Reserve Board is raising interest rates because of a concern about inflation, then that doesn’t bode well. Currently, the historical research and data does not pose significant cause for concern.

Additionally, we can glean a lot from the long-term data as we assess the current state of market trends. Looking at the 15-year period from 2003 to 2017, risk-return is alive and well.

For example, the annualized return on emerging market equities is 12.7%, while the emerging market equities volatility is 23%. This further proves the old investment adage that Steve has talked about, which is that the highest returns also come with the highest volatility.

Portfolio Outlook

The San Diego Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

While we are watching current market shifts closely, the intra-year decline we are experiencing can send a lot of false signals to investors who prefer to time the market. Historical data favors those who take a more long-term, disciplined approach like The Foundation and therefore we are confident in the current value-driven investment strategy.

On the call, Steve Klosterman and I discussed in more detail our investment strategies and key drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

Read more about how we help grow your giving with our investment strategy and performance.

About Matt Fettig, CFA