We understand that no single investment plan can meet every donor’s needs.

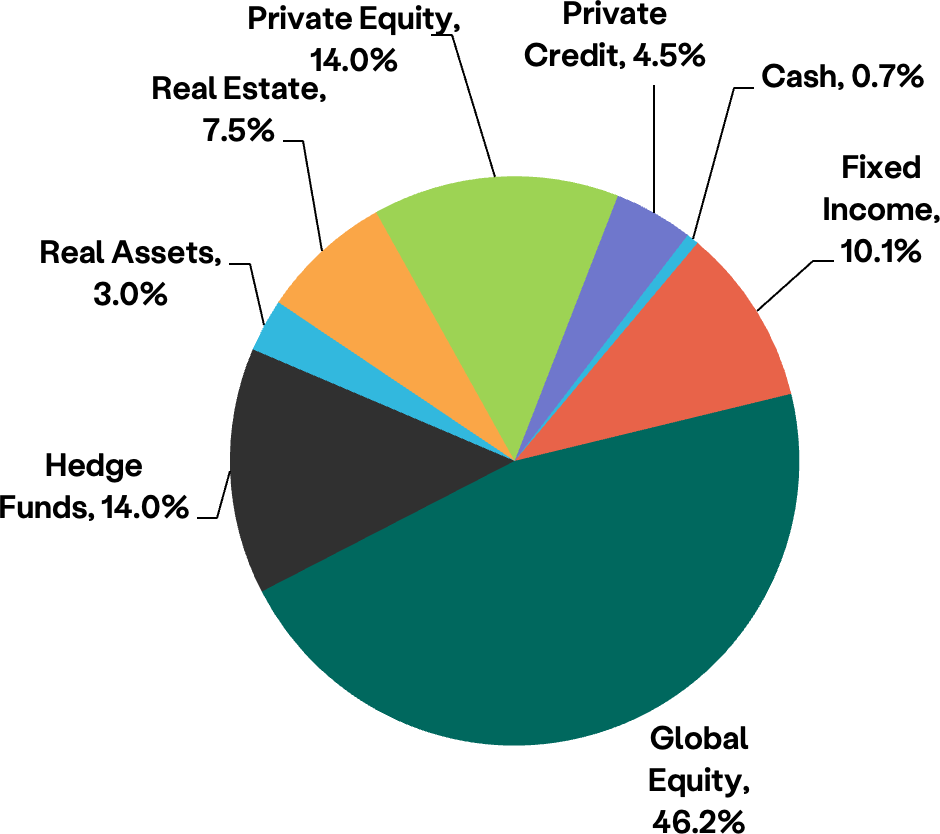

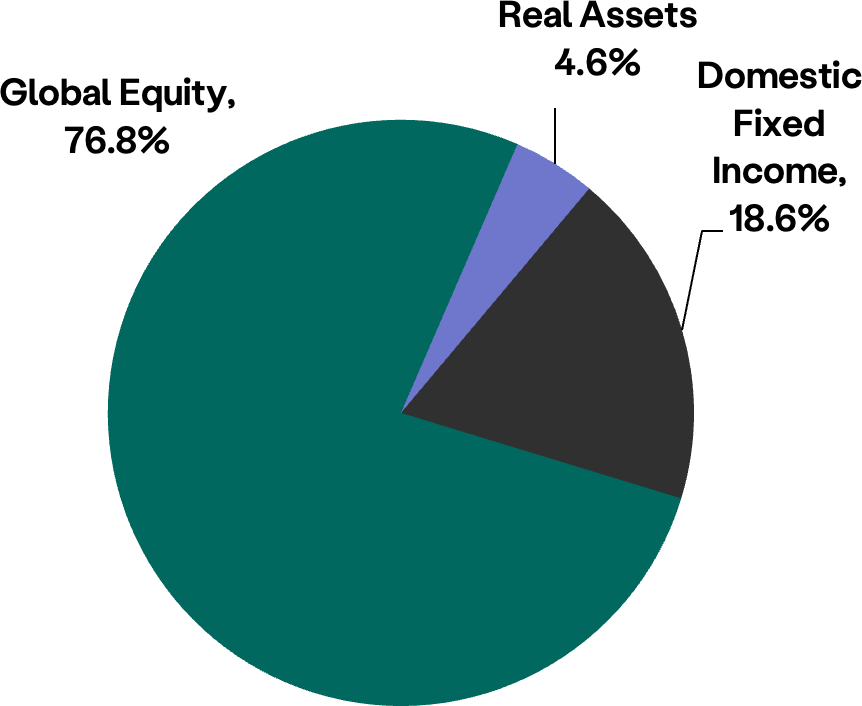

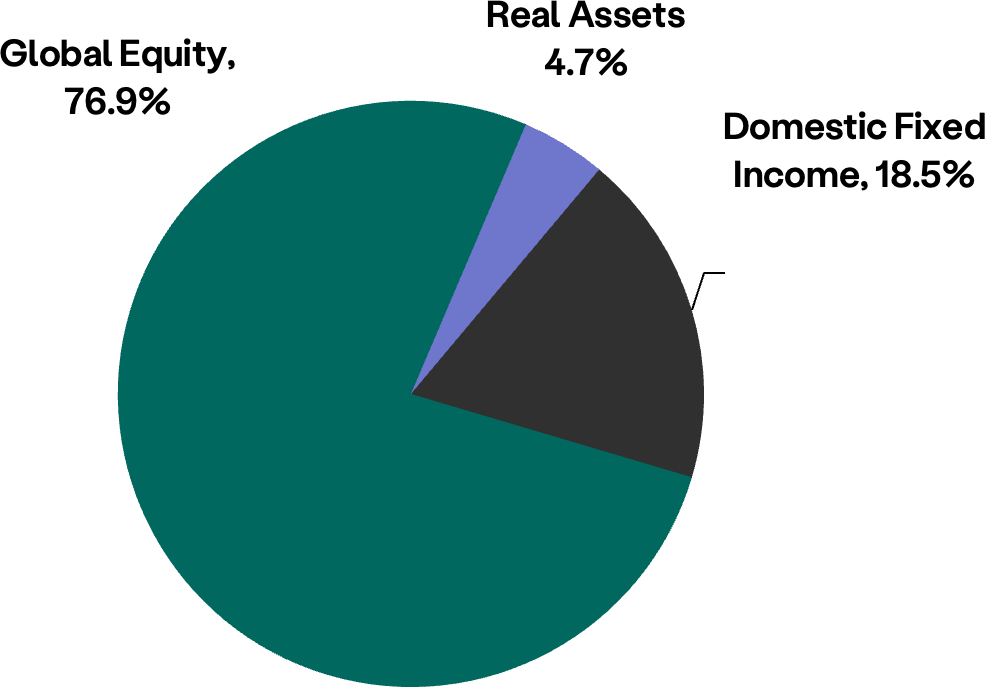

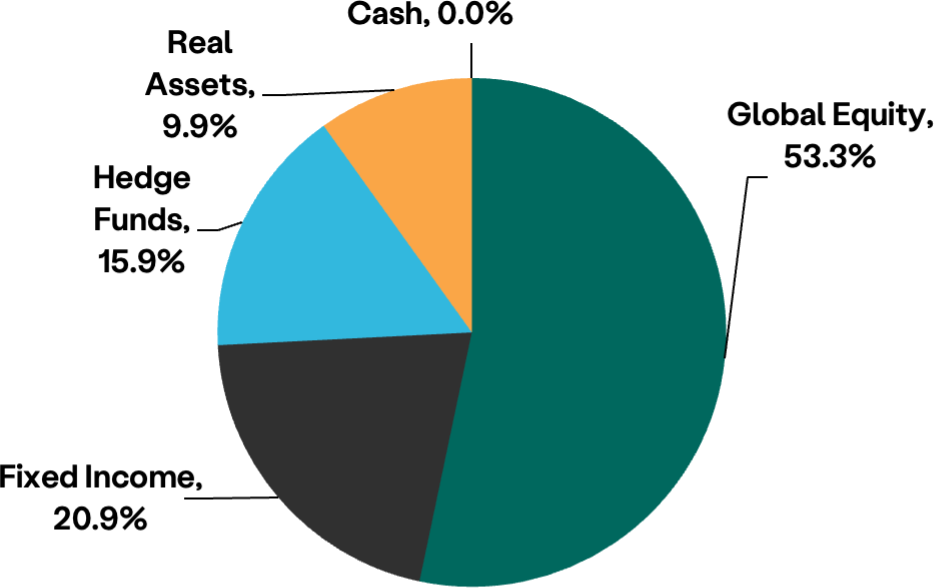

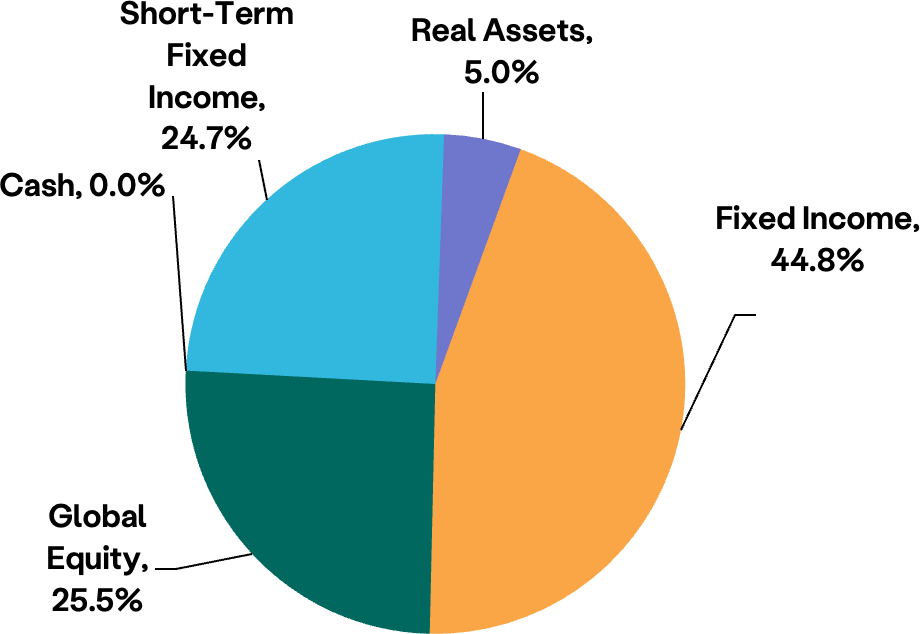

When you choose to invest your fund in one of our seven portfolios, you’re choosing world-class investment managers and strategies. All investments are overseen by our experienced Investment Committee and Investments team on-staff.

Choose from one of our professionally managed investment portfolios to meet your grantmaking objectives, whether they are short-term or long-term:

Investment Performance

Watch Chief Investment Officer Matt Fettig, CFA share our most recent Investment Performance update, or view past updates.

Performance of investment portfolios through December 31, 2023:

| 3 Months | YTD | 1 Year | 3 Years | 5 Years | 7 Years | 10 Years | |

|---|---|---|---|---|---|---|---|

| Endowment Portfolio | 5.7% | 10.8% | 10.8% | 6.4% | 9.8%% | 8.2% | 6.8% |

| Sustainable Endowment Portfolio | 11.1% | 11.0% | 11.0% | -0.4% | - | - | - |

| Sustainable Non-Endowment Portfolio | 11.% | 11.0% | 11.0% | -0.5% | - | - | - |

| Long-Term Non-Endowment Portfolio | 7.6% | 13.2% | 13.2% | 4.0% | 8.3% | 6.9% | 5.6% |

| Medium-Term Non-Endowment Portfolio | 7.0% | 9.8% | 9.8% | 0.0% | 4.7% | 4.3% | 3.4% |

| Intermediate-Term Non-Endowment Portfolio | 5.7% | 6.5% | 6.5% | - | - | - | - |

| 9/30/21 | 12/31/21 | 3/31/22 | 6/30/22 | 9/30/22 | 12/31/22 | 3/31/23 | 6/30/23 | 9/30/23 | 12/31/23 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Short-Term Non-Endowment Portfolio | 0.00% | 0.00% | 0.00% | 0.20% | 0.50% | 0.90% | 1.10% | 1.20% | 1.30% | 1.40% |

Investment Committee

With over 150 years of combined global and domestic expertise, the San Diego Foundation Board of Governors Investment Committee drives asset management and investment growth to meet fund objectives.

The Investment Committee is committed to:

- Protecting the corpus of the Foundation

- Preserving the spending power of the income from the fund

- Maintaining a diversified portfolio of assets in order to meet investment return objectives while keeping the level of risk commensurate with that of the median fund in a representative

- foundation and endowment universe

- Complying with applicable law

Investment Committee Members

Connect with Our Giving Team

Your philanthropy is personal, and we are here to help you by delivering world-class service and promptly responding to your needs.

Our experienced staff understands the technical complexities of charitable giving and helps simplify the process. We are your personal support team here to help you manage your fund(s) and give confidently.

Contact us at (619) 814-1332, email us or submit a Contact Form.