Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donors’ social investments.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q3 2017 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

Recent Trends

Following strong performance over the past year, Steve Klosterman, Regional Director with Halbert Hargrove and Foundation Board Investment Chair, spoke about the trends that are driving the market and what to expect in the coming months.

As he described during our Q3 2017 call, the United States is in its ninth year of an economic expansion. At the time of the call, the Federal Reserve Board was preparing to increase interest rates by .25% and the Investment Committee is closely watching the market reaction to manage any economic impacts to our current asset base.

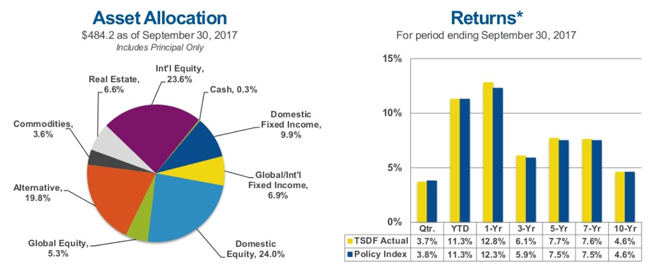

Currently, as we have discussed about on previous investment calls, our portfolios have a tilt toward the international markets and have benefitted greatly from this strategy in recent quarters. Emerging markets continue to produce promising returns and we are encouraged by our investment performance during the past year.

The ongoing strength of the market is an encouraging sign but we maintain a critical eye, particularly on asset allocation, in case we are late in an economic cycle.

Portfolio Outlook

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

The San Diego Foundation Investment Portfolio has performed well in comparison to its fellow foundations and like-minded organizations. Our positioning in the equity markets continues to yield positive results.

Specifically, emerging markets have been one of the strongest drivers of performance in the quarter and year-to-date periods. In addition, the strength of the U.S. market and our relative over-weight in non-U.S. developed stocks has resulted in a strong portfolio performance.

Overall, The San Diego Foundation’s positive investment results over the course of the last several years have enabled us to exceed our policy index in the long-term.

On the call, Steve Klosterman and I discussed in more detail our policy index benchmarks and key drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

Learn More About our Investment Strategy & Performance

About Matt Fettig, CFA