Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donors’ social investments.

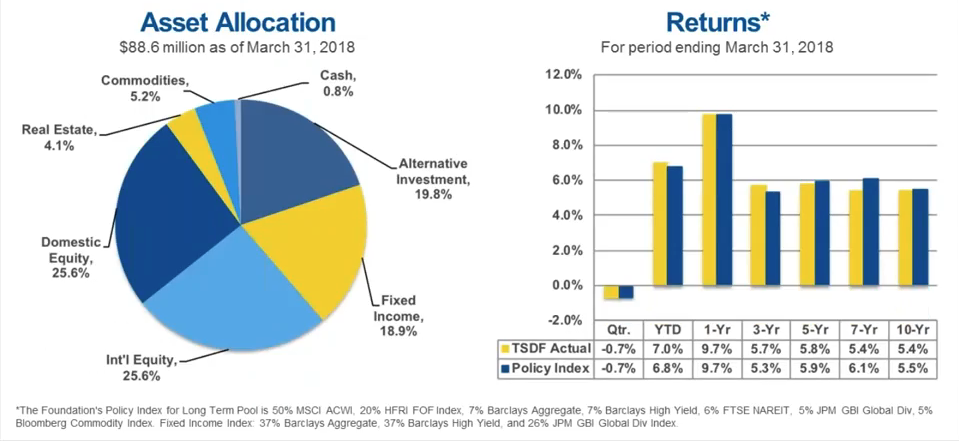

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q1 2018 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

Recent Trends

Steve Klosterman, Regional Director with Halbert Hargrove and The San Diego Foundation Board Investment Chair, kicked off the call and spoke about the trends that are driving the market.

As he described during our Q1 2018 call, markets are currently experiencing a high degree of volatility due to a number of macroeconomic factors. Over the past several months, many global indices experienced both a downturn and rally back, which is why The Foundation maintains a highly diversified portfolio and doesn’t react to short-term market volatility.

Additionally, Steve spoke about the effects tariffs may have on the economy, given the recent headlines around the world. He noted that while much is still to be determined, there will be winners and losers as a result of the proposed tariffs and because of that, the Investment Committee is closely watching the global developments around tariffs.

Portfolio Outlook

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

The Investment Committee is in the midst of making changes to the portfolio that will strengthen The Foundation’s position in the market relative to current shifts in the global economy.

Years ago, during an overall declining interest rate environment, from the mid-1980’s up until recently, it was easy to have a significant portion of a portfolio in fixed income and earn a nice return. Today, trends indicate that those days may be over and The Foundation has lightened up on its diversified fixed income exposure and emerging market debt exposure as a result. The reason for this is because the value of taking on credit risk is declining as we move later into the economic cycle. Fortunately, we have been very timely as the dollar has started to rally and many emerging market currencies have fallen.

Over the coming months, the Investment Committee will be closely monitoring market shifts and trends to identify further action to strengthen the portfolio and maximize returns for our donors.

Learn More

On the call, Steve Klosterman and I discussed in more detail our policy index benchmarks and key drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

Read more about how we help grow your giving with our investment strategy and performance.

About Matt Fettig, CFA