As the global economic market continues to grow and evolve, investors and donors alike are wondering what the future holds.

At The San Diego Foundation, we believe it’s important to regularly communicate our investment strategies and market position to provide donors with continuous support and education regarding their charitable funds.

Whether that’s through quarterly investment webinars or the annual Investment Summit, transparency is at the forefront of The Foundation’s investment activity.

Performance & Trends

Last month, we invited donors to The Foundation for the 2019 Investment Summit. The annual event provided attendees with the opportunity to learn more about our investment strategies and discuss how recent trends are driving the global market.

Keynote speaker Shelly Heier, president & chief operating officer of national investment consulting firm Verus Investments, was on hand to provide an in-depth look at global trends and how charitable giving is impacted by recent economic shifts.

As Shelly explained, 2018 will be remembered as the year that volatility returned to the market. After several years of low interest rates and highly accommodative central bank policy globally, tightening conditions in the U.S. and slowing growth abroad led to a volatile year for most major asset classes.

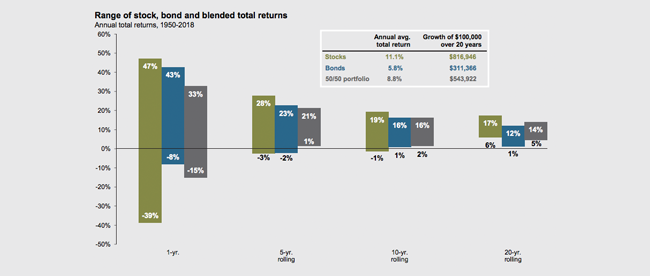

Despite a challenging year, we continue to look at the positive, long-term results of our portfolios to determine overall value to our donors. As history has proven, the range of market outcomes reduces over longer periods of time, ultimately favoring long-term investment portfolios, including those at The San Diego Foundation. While simplistic portfolios have done well recently, they do not reflect historical trends nor do we believe their short-term success is indicative of the future.

Our investment strategy is structured to enable donors to maximize their philanthropic impact over the long-term.

Managing Charitable Investments

The San Diego Foundation Investment Committee takes a long-term, value-oriented approach to investing.

As Investment Committee Chair Steve Klosterman and Vice Chair Kevin Hamilton shared during the event, The Foundation Investment Committee, which is made up of industry professionals with more than 150 years of combined global and domestic expertise, focuses on finding undervalued asset classes to achieve the best risk-adjusted returns for donors.

Since 1975, we have helped thousands of San Diego donors grant more than $1.1 billion to advance a vibrant quality of life in San Diego.

By pooling charitable assets, including more than $500 million in our Endowment Pool, we have significant economies of scale to invest with the best and brightest minds at a very reasonable overall investment cost. Most importantly, we build investment strategies that increase the impact of charitable giving in the region, create sustainable growth and help donors improve quality of life in San Diego and beyond.

Read more about our investment strategy and performance.