As the first quarter of 2017 comes to a close, we took a moment to sit down with Chief Investment Officer (CIO) of The San Diego Foundation Matt Fettig to discuss The Foundation’s strong investment performance over the last year, passive vs. active investing models, alternative investments and more.

How have your past experiences contributed to your Chief Investment Officer role at TSDF?

I spent over 12 years at Canterbury Consulting, a large investment firm. At Canterbury, I learned a lot about managing institutional money, particular in the non-profit sector. I brought a strong understanding of asset allocation, investment manager research, and portfolio construction with me to TSDF. Fortunately, I was able to hit the ground running when I joined TSDF.

That said, all investment decisions at TSDF are made by our Investment Committee. When I first joined, my primary goal was to build trust with the members of that Committee. We’ve developed into a strong team and as a result, implemented some changes at the margin to the portfolios, which I believe are starting to bear fruit.

Recent performance results for all The San Diego Foundation investment portfolios have been strong. What is driving these results?

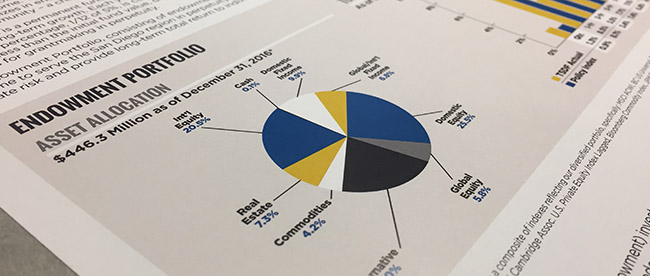

We are fortunate that our short-term results have been strong over the last year. For the one year period ending February 2017, our Endowment portfolio was up 17.3%, our Long-Term portfolio was up 18.3%, and our Medium-Term portfolio was up 11.1%.

Of course, as an institutional investor we take a long-view approach. Strong short-term results do positively impact long-term returns. Also, you have to remember this is coming off of 2015, in which each of the portfolios was down slightly. Our exposure to non-US assets hurt us in late 2015 with the strong rally in the US dollar.

2016 was a different story. Emerging markets equities, an area in which we hold a relative overweight, were the best performing asset class for the year. Just about all asset classes produced strong results.

What are your beliefs about passive vs. active investing?

My belief, which is shared by our Investment Committee, is that investors should not pay active management fees in areas of the capital markets that are deemed “efficient.” As such, our entire US equity portfolio is invested passively in low-cost index funds.

We do, however, believe that certain areas of the market are less efficient. Emerging markets is a perfect example. We also believe the fixed income market is still relatively inefficient. In inefficient areas of the market, we hire active managers under the belief that they can outperform their indices net of fees.

You also mentioned exposure to non-US assets. Why have you positioned TSDF portfolios with more exposure to non-US assets than some of your peers?

Long-term valuation plays an important role in allocating assets across different asset classes or geographies. While the US equity market has been particularly strong, it is also trading above its historical average valuations. Non-US developed and emerging markets equities, starting at a lower valuation point, should offer us more upside than the US over the next 10 years.

We are preparing for an asset allocation study and recently looked at our investment consultant’s forward 10-year projections for various asset classes. The projected return for US equities over the next 10 years is 4.7%. US bonds, given the historically low interest rate levels of the last several years, have a forecasted return of 3.3%.

It doesn’t sound like you’re a big believer in the old-school “60/40” or “70/30” portfolio mix.

I don’t think I’m alone in that. A combination of those two asset classes is not going to get us to our desired rate of return, particularly for the Long-Term and Endowment portfolios, where we are striving for 7.5% plus.

It is crucial that we diversify our assets into other areas of the market. Over the last several years, our Investment Committee has recognized this and has moved into other areas of the market where we believe we can achieve our desired rate of return.

A portion of the Endowment and Long-Term portfolios are invested in “alternatives.” What are these assets and why do they play an important role in your asset allocation?

Alternative investments has become somewhat of a “catch-all” phrase. I broadly divide alternatives into three different areas.

The first is hedge funds. Hedge funds generally have a negative connotation because they charge high fees and lack transparency. When we look at our Endowment portfolio, a substantial amount of the risk we are taking is correlated highly to the equity markets. Over the last two years, realizing that the current economic cycle has lasted longer than the average cycle, we’ve had a desire to reduce our equity risk.

There are a few ways we considered doing it. We could change our asset allocation to reduce equities, but that meant sacrificing potential return. We could implement a hedging program, but that can be quite expensive and also reduce potential return. At the end of the day, we think hedge funds still serve a purpose as a risk-reducing and diversifying strategy.

The next bucket is private capital. Private capital can include things like venture capital, growth equity, leveraged buyouts, distressed debt, and other opportunistic strategies. The problem with private capital is that it’s largely an illiquid asset class. That said, studies have demonstrated an illiquidity premium of 3-5% over liquid markets. In our Endowment portfolio, a portfolio with an infinite time horizon, we can take on some illiquidity in exchange for higher returns. This serves as an important area in helping us meet our Endowment return objectives of 7.5% plus.

The last area is Real Assets. Real assets tend to have a hard asset component, such as Commodities or Real Estate. Most importantly, they tend to have a high correlation with inflation. Inflation is constantly eroding the value of your money. We invest in private Real Estate, which we believe behaves differently from stocks and bonds and also offers an illiquidity premium. We also invest in Commodities. While very volatile, Commodities tend to have one of the highest correlations to inflation and fairly low correlations to public markets. All of that said, it is important to size the position correctly given the higher levels of volatility.

What potential changes will you be making to the portfolios in future years?

Overall, I would expect our Endowment portfolio, where we can tolerate some additional illiquidity, to continue to focus on alternative investments. I expect that we will continue to build out our exposure, at the margin, to areas like private capital and real estate. The public markets are unlikely to provide us with the return potential to meet our objectives. While these areas add additional complexity to our portfolio, we feel well equipped to take advantage of opportunities going forward.