Since 1975, The San Diego Foundation and our donors have granted more than $977 million to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes our Investment Committee and staff works to maximize the impact of our region’s collective social investments by making prudent investment decisions.

Our new Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q2 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

Recent Trends

As Horacio Valeiras, Principal at HAV Capital and Foundation Board Investment Chair, shared on our Q2 call in August, last quarter the market reflected an economic outlook of slow growth, low interest rates, and continued economic and monetary stimulus. Since then, the biggest news that has impacted the market is Great Britain’s decision to withdraw from the European Union. As most experts expected, the market reaction was initially very negative. Most markets declined over the first few days following the vote, but shortly after there was a reversal, particularly in the U.S. which hit new highs.

There are many indicators that we can draw from, but the market trends since the vote tells us that there is still uncertainty about what the future holds for Great Britain and its impact on the rest of the world. We believe it will take at least two or three years to figure out the true impact of Great Britain’s decision.

We continue to monitor the global market reaction but thus far the world reacted quickly, and then rebounded to normal levels.

Portfolio Outlook

The Foundation’s Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

As we look at Q2 results and compare to our policy index, we are encouraged by an above average quarter for our endowment portfolio. Across all asset classes, we performed well with U.S. equities delivering the strongest results.

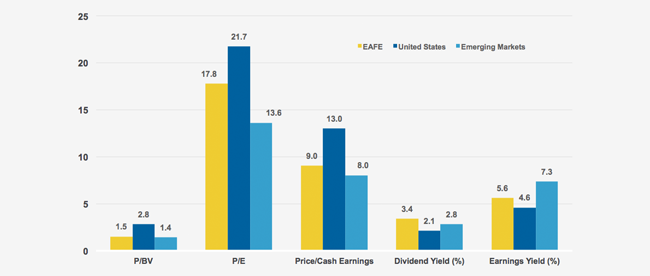

In addition, one of the most significant points of distinction across all our portfolios was our position in emerging markets equities. Relative to our benchmark and other comparable institutions, we have an overweight in this area which performed well for the quarter.

On the call, Horacio Valeiras and I discussed in more detail the impact of global trends and drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

About Matt Fettig, CFA