Since 1975, The San Diego Foundation and our donors have granted more than $1.1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the Q2 2019 call and review the slides shared by our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt] https://www.youtube.com/watch?v=IW3ziYj_GmM[/embedyt]

Recent Trends

Steve Klosterman, Regional Director with Halbert Hargrove and The San Diego Foundation Board Investment Chair, kicked off the call by speaking about the trends that are driving the market.

Using charts listing out the historical peaks and valleys in the market, Steve demonstrated why it’s important not to time the market. Data shows that during the past 20 years, six out of the 10 best days for the market occurred within two weeks of the 10 worst days.

This is particularly important now more than ever, given the public’s concerns over global economic volatility. When assessing returns, it’s necessary to remember that the markets historically favor long-term investing, which is why we maintain our position as value-driven investors for the benefit of our donors.

Portfolio Outlook

As we’ve shared in previous calls, The San Diego Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

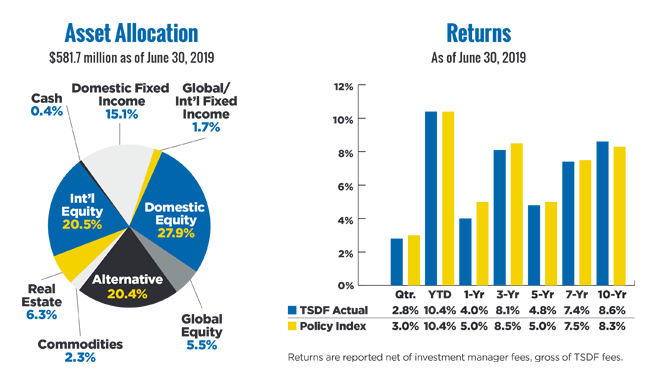

Currently, we are encouraged by the long-term returns realized in the endowment portfolio. We continue to outperform the 10-year benchmark, which is a positive sign for our endowment fund holders who want to give more to the nonprofit community over time.

We are also seeing strong signs from key asset classes within our other portfolios. On the call, Steve Klosterman and I discussed these drivers of portfolio performance, as well as our investment strategies. I encourage you to listen to the full recording for further insight and information to help you maximize your charitable investments and grantmaking.

Read more about how we help grow your giving with our investment strategy and performance.

About Matt Fettig, CFA