Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to nonprofit organizations and programs that advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q2 2017 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt] https://www.youtube.com/watch?v=uR5BbPf9VwY[/embedyt]

Access the presentation slides >

Recent Trends

Following strong performance over the past year, Horacio Valeiras, Principal at HAV Capital, spoke about the trends that are driving the market and what to expect in the coming months.

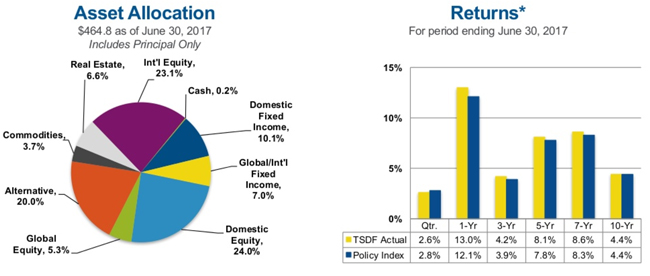

As he described during our Q2 2017 call, The San Diego Foundation endowment and non-endowment portfolios, like many in the market, have benefitted from the strength of return from equities over the past year. Our positions in Emerging Markets and other non-US assets were significant drivers of performance.

Horacio also addressed the tragic events caused by Hurricane Harvey and Irma. As history has shown, major disasters in the U.S. can have significant impacts on economic activity and investments. For example, as people prepare for large storms, they tend to increase economic activity. But during and after the storm, local spending activity decreases as families rebuild their lives and communities. While the storm can alter specific business sectors, the impact on the investment portfolio overall is muted because of our exposure to a diversity of assets.

Portfolio Outlook

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

Many of the themes we have talked about on recent investment calls remain true today. For example, non-US equity markets continue to outperform, which significantly benefits us given our relative overweight position in emerging markets. We also continue to see strong returns from spread-sector fixed income such as high yield bonds. The only area that saw a negative return was the commodities asset class.

Most importantly, each of The Foundation’s investment portfolios have either met or outperformed the policy index for the 1-year through 10-year tracking. As a result, we rank above the competitive median during those time period, which is a mark we strive to maintain to ensure the strongest investments for our donors.

On the call, Horacio Valeiras and I discussed in more detail our policy index benchmarks and key drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

Learn more about our Investment Strategy & Performance

About Matt Fettig, CFA