Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments with their regional community foundation.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q1 2017 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt]https://www.youtube.com/watch?v=2APZ7IdJaXo[/embedyt]

Recent Trends

Following strong performance over the course of 2016, Horacio Valeiras, Principal at HAV Capital and Foundation Board Investment Chair, spoke about the trends that are driving the market and what to expect in the coming months.

As he described during our Q1 2017 call, one of the most notable shifts relates to the “Trump Trade,” which is categorized as the rise in U.S. stocks and Treasury yields following Donald Trump’s victory in the U.S. presidential election. Since March 2017, many asset classes, such as small cap stocks and financial services, have started to underperform, which is an indicator that the Trump Trade may be beginning to reverse itself.

Horacio also spoke about economic growth in the U.S. and globally. While many know that Q1 2017 was not particularly good for the U.S. economy, the unemployment rate has continued to strengthen and the most recent ADP figures show that companies continue to hire in the U.S.

Beyond the U.S., emerging markets are still showing strong economic growth and we are encouraged by the figures, which is why we believe the global environment is still good for emerging market assets.

Lastly, Horacio provided a snapshot on what we can expect over the next year. Investors forecast that short-term interest rates will rise in six months and again in twelve months, while long-term interest rates remain static. According to Horacio, “This flattening of the yield curve will likely create a slowdown in the economy, which means we shouldn’t expect the U.S. economy to heat up in the near future.”

Portfolio Outlook

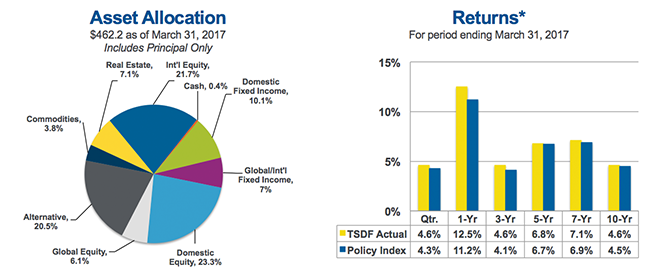

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

Many of the themes we see from the Endowment Portfolio performance in Q1 2017 are consistent across the other Portfolios we manage for donors. For example, emerging markets were the strongest performer, up over 11 percent, and the returns experienced in the first quarter played very well to our positioning across all our Portfolios.

As we’ve mentioned previously, The San Diego Foundation has been positioned with a relative overweight in emerging markets, particularly in non-U.S. markets. This continues to be a strong driver of our performance against the policy index year-over-year.

Many experts agree that bonds are overvalued and over the course of the last year, the bond index has been flat. However our bond performance for Q1 2017 was 7%. This significant variation is largely due to the performance of strong investment managers, as well as our position outside of the non-traditional bond markets, such as high-yield and emerging market bonds.

On the call, Horacio Valeiras and I discussed in more detail the impact of global trends and drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

Learn More About our Investment Strategy and Performance

About Matt Fettig, CFA