Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes our Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments with their regional community foundation.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q4 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt]https://www.youtube.com/watch?v=AzOCv3m5mXc[/embedyt]

Recent Trends

Following strong performance over the course of 2016, Horacio Valeiras, Principal at HAV Capital and Foundation Board Investment Chair, spoke about the trends that are driving the market and what to expect in the coming months.

Since the election in November, it’s been a particularly good period for the stock market in the U.S. Notably, U.S. equities have been strong with more than a 6 percent gain, and European and Asian equities have appreciated, albeit at a slower rate due to the strength of the dollar following the election outcomes.

One important indicator that Horacio spoke about was the earnings shift in comparison to the last five quarters. For five continuous quarters, we had an “earnings recession.” While the economy continued to grow, earnings for the S&P 500 dropped quarter over quarter. However, based on the most recent quarter, the earnings recession seems to have ended and analysts expect the numbers to grow.

Horacio continued by reviewing possible outcomes of a Trump presidency. He explained, “If President Trump pursues corporate tax reform that decreases the tax to 15 percent, or promotes an infrastructure spending deal, that would be a positive for market performance. Conversely, more turmoil and uncertainty in international trade policies could hurt the strength we’re currently experiencing.”

Right now, we are cautious but optimistic as we look ahead to 2017.

Portfolio Outlook

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

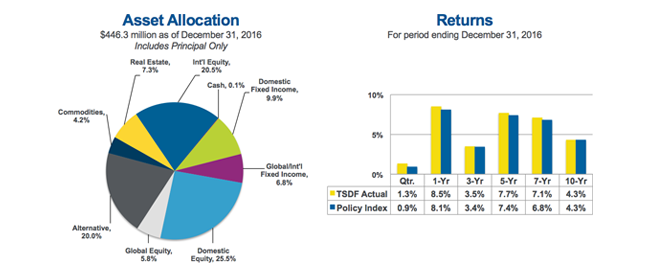

In the fourth quarter of 2016, we were up 1.3 percent in the endowment portfolio and 8.5 percent for the one-year period. When comparing that one-year performance to similar community foundation endowments, we’re ranking very strong in the 6th percentile. From that perspective 2016 was a good year and over the long term we are seeing a recovery from previous “flat” years.

When looking at the drivers of performance for the one-year period, U.S. equities (particularly small cap equities) continued to be a strong performer. The same goes for emerging markets, which have seen quite a reversal from previous years.

Following the election of President Trump, we had a large backup of interest rates. Most of us were waiting for this backup to occur and we expected a significant shift because typically when rates go up bond prices go down. However, thanks to one standout manager in our fixed income portfolio, we not only sustained the rise in interest rates in the fourth quarter but we produced a positive rate of return.

On the call, Horacio Valeiras and I discussed in more detail the impact of global trends and drivers of portfolio performance. I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

More About Our Investment Strategy & Performance

About Matt Fettig, CFA