As many of us know, college is expensive. And having access to resources that offset these costs can make the difference in both attending and graduating from college. This blog series will explore the seen and unseen costs of higher education through the lens of local students and data.

According to the non-partisan California Budget and Policy Center, the cost of higher education within the California State University system has increased 1300% over the past four decades.

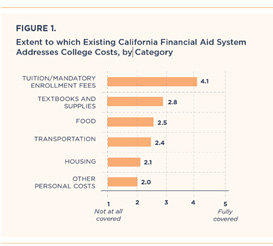

While many people immediately think about tuition and fees, these are costs most often covered by federal funding (Pell grants), state funding (Cal grants) and, especially at private universities, institutional grants. Non-tuition costs are increasingly becoming more significant barriers to graduation among all students.

A recent study by the Institute for College Access & Success echoes the conclusions of the California Budget and Policy Center report. According to

While much federal, state and local funding is primarily channeled into public and private four-year universities, the study also found that non-tuition costs are particularly prevalent among community college students.

Kelly, a single-mother and San Diego City College student pursuing her degree, spoke about the extra expenses and challenges that are common among her peers. Kelly explained, “It’s a catch-22. Community college students, particularly those with families, need to make more money to afford the extra expenses but we don’t have the time to get that job or else we may see a drop in our grades and lose what financial aid we already have.”

Kelly’s situation elucidates the fact that a lack of even one resource can set off a chain of events that can deter college completion for countless students.

Community college students are comprised of a much higher percentage of working adults and low-income students than four-year universities. In fact, research from the Hope Center uncovered startling figures:

- 19% of California’s 2.1 million community college students have been homeless during the past year

- 60% of community college students are housing insecure

- 50% of community college students have been food insecure in the past 30 days

Last year, The San Diego Foundation awarded nearly $2.7 million in scholarships to 852 students. More than 10% of those students are attending

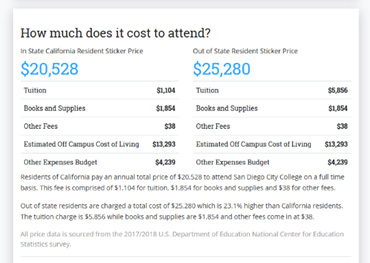

For example, according to the U.S. Department of Education, San Diegans end up paying $20,528 annually to attend San Diego City College (SDCC).

While these figures are concerning, there are a number of ways they are being addressed to help students like Kelly.

For low-income students, the San Diego Promise Program may cover up to two years of tuition, but will not cover any other expenses. Students can fill out a Free Application for Federal Student Aid (FAFSA) to help cover their cost of attendance, but this often falls short of the estimated $20,528 needed for a student to cover expenses while attending SDCC.

Federally, efforts are being made to ensure student awareness of SNAP (CalFresh in California) food benefit programs, and community colleges continue to build program services that provide resources for students who are housing and food insecure.

How can local philanthropy help?

It’s important to understand that college costs comprise more than tuition and fees – books, food, housing, childcare, a computer – can all make the difference in students pursing and completing their post-secondary studies. This is especially true for community college students.

Ensuring that scholarships cover non-tuition costs can serve as a good first step in student success.

Help students pay for and persist through college by donating to our Community Scholars Initiative or opening your own scholarship fund at The San Diego Foundation.