Although the stock market has been volatile in 2021, the S&P 500 Index has hit record highs. For wealth advisors, that means many of your clients may have highly appreciated securities in their portfolios.

Rebalancing your client portfolios during the fourth quarter often means selling investments that have appreciated, typically resulting in capital gains tax.

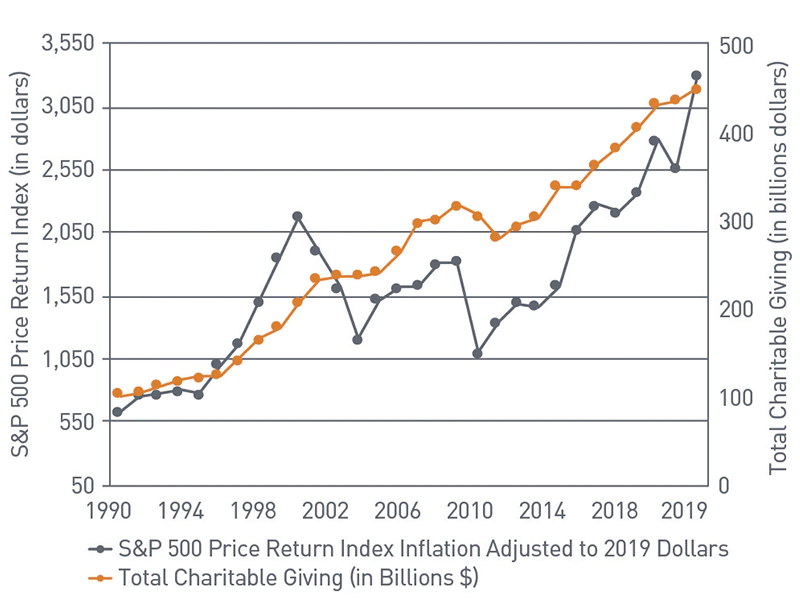

One simple offsetting measure is to align your clients’ charitable giving with the rebalancing process. History indicates clients are more willing to adhere to this strategy during years in which the S&P 500 Index performs strongly, as is the case in 2021.

Recently, I have seen many San Diego wealth advisors turn to an increasingly popular charitable giving investment solution that minimizes taxes and maximizes philanthropic impact: Donor-advised funds.

If your client itemizes deductions on their tax return, donating long-term, appreciated securities (stocks, bonds, mutual funds, real estate or fund shares) to a donor-advised fund is a strategic win-win:

- First, clients eliminate the capital gains tax they would incur if they sold the assets and donated the proceeds, which may increase the amount available for charity by up to 20 percent.

- Second, clients can claim a fair market value charitable deduction for the tax year in which the gift is made and may choose to pass on that savings in the form of more giving.

By avoiding capital gains tax, your clients can leverage their contribution for a larger financial impact while also securing a better tax break. In other words, their charitable investments and assets go much further.

Illustration: Donating Appreciated Securities

By donating appreciated stock held for more than one year directly to a donor-advised fund – rather than liquidating it and then donating the proceeds – clients can reduce their tax liability by eliminating capital gains tax, as well as reducing their marginal income tax.

In the example below, a client has $100,000 in long-term appreciated stock, with a $10,000 cost basis.

| Client Sells Securities and Donates After-Tax Proceeds to Charity | Client Contributes Appreciated Securities Directly to Charity | |

| Cost Basis | $10,000 | $10,000 |

| Value of Appreciated Securities | $100,000 | $100,000 |

| Capital Gains Tax | $13,500 | $0 |

| Net Available to Charity | $86,500 | $100,000 |

Assuming a 35 percent income tax rate and a 15 percent long-term capital gains rate, the donor-advised fund allows this client to avoid tax on their $90,000 gain and give more to charity ($13,500).

In addition to income and capital gains tax benefits, donor-advised funds are not subject to estate tax.

Lastly, the contribution to a donor-advised fund is invested, meaning the fund has the potential to grow tax-free and provide additional funding to your client’s favorite causes and nonprofit organizations over time.

Open a Fund Before Year-End Deadlines

Donor-advised funds are powerful philanthropic vehicles because your clients are able to contribute any cash or non-cash asset to the fund, take an immediate tax deduction in that calendar year, then support a nonprofit or cause when the time is right.

To get started with donor-advised funds, you need to pick a charitable sponsor, such as The San Diego Foundation.

The Foundation acts as a charitable partner for wealth advisors, helping advisors and clients achieve charitable goals and maximize tax deductions through donor-advised funds and other customized charitable solutions that match your clients’ needs

If your clients are seeking a tax deduction in this calendar year, it’s important they donate assets by these 2021 deadlines:

- Mutual fund donations must arrive to The Foundation by November 22.

- Stock donations must arrive to The Foundation brokerage accounts by December 29 at 1:00pm.

- Credit card donations must be processed by The Foundation by December 30 at 12:00pm.

- Checks arriving by mail must be postmarked by the U.S. Post Office by December 31.

- Electronic Bank Transfer funds must be received by December 31.

- Wire Transfer funds must be received by December 31.

Interested in learning how donor-advised funds can meet your clients’ financial planning and charitable giving goals? Contact our Director, Wealth Advisor Relations today.

Jason Rogers, AIF, CWS

Director, Wealth Advisor Relations

jrogers@sdfoundation.org

(858) 245-1508