Since 1975, The San Diego Foundation and our donors have granted more than $1.1 billion to nonprofit programs improving the quality of life in San Diego County and beyond.

While most often we talk about the significant impact these programs and local donors have within our communities, behind the scenes the Investment Committee and I as Chief Investment Officer work to maximize the impact of our donor’s social investments.

Our Quarterly Investment Conference Calls provide donors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the Q3 2019 call and review the slides shared by our team of experts to learn more about global trends, portfolio performance and market expectations.

Recent Trends

Our Chair of the Board of Governors Investment Committee Steve Klosterman, Regional Director with Halbert Hargrove, started off by discussing the trends that are impacting the market in recent months.

As Steve has shared on previous calls, the U.S. economy is largely consumer driven, and at the moment we have low unemployment combined with some wage growth, which may positively impact consumer spending going into the holiday season and ultimately bode well for our national economy.

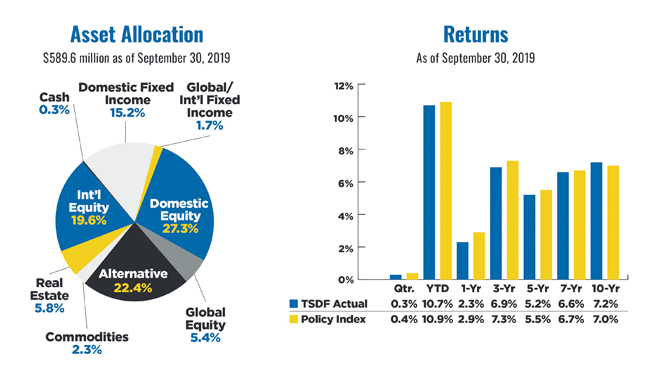

On the global scale, the evolving tariff environment continues to affect certain asset classes. Fortunately, our portfolio diversification and long-term market outlook has allowed us to maintain positive returns for our donors even in the wake of a somewhat volatile macroeconomic landscape.

Portfolio Performance

The San Diego Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

We manage our endowment portfolio in a highly-diversified fashion and it is designed to last forever, which allows us to take on exposure to even more asset classes that strengthen our diversification. So far in 2019, we have generated strong year-to-date returns for our donors who are invested in the endowment portfolio. That is largely attributed to a decline in interest rates, causing bond prices to rise significantly, as well as a rebound from equities since January 1.

It is also important to note that our private real estate investments have reached a level of maturity and are offering strong returns for donors over the course of the last 3-10 years, one of our strongest portfolio areas today.

New Investment Opportunity

On the call, we also announced a new investment option for our donors. In line with our robust Climate Program, I’m excited to share that effective January 1, 2020, we will be expanding the environmental, social and governance criteria of the Social Equity Portfolio to minimize exposure to fossil fuels. This option will also be available in both an endowment and non-endowment portfolio to better support donor needs.

If you invest in a set of values and those values align with this type of fund, we encourage you to reach out to your donor manager for more information.

For more information about our portfolio performance and investment strategies, you can listen to the latest Investment Conference Call recording for further insight and information to help you maximize your charitable investments and grantmaking.

About Matt Fettig, CFA

As Chief Investment Officer, Matt oversees and manages the investment strategies and activities of The San Diego Foundation. He works with the Investment Committee of the Board of Governors, senior staff, investment managers, auditors and outside consultants to develop investment strategies that maximize returns and help grant more money to local nonprofit organizations, helping to improve the quality of life in San Diego.

As Chief Investment Officer, Matt oversees and manages the investment strategies and activities of The San Diego Foundation. He works with the Investment Committee of the Board of Governors, senior staff, investment managers, auditors and outside consultants to develop investment strategies that maximize returns and help grant more money to local nonprofit organizations, helping to improve the quality of life in San Diego.

More About Matt